This article is an excerpt from the Shortform book guide to "The Deficit Myth" by Stephanie Kelton. Shortform has the world's best summaries and analyses of books you should be reading.

Like this article? Sign up for a free trial here .

Why do we have to pay taxes? If monetary sovereigns can print their own money, then why do they still need tax money? Are there other reasons for tax other than to pay the government?

According to modern monetary theory, nations that are monetary sovereigns can print more money whenever they need it. However, according to economist Stephanie Kelton, that doesn’t mean that taxes don’t serve a purpose.

Learn why a believer of MMT believes taxes are still important.

Why We Need Taxes

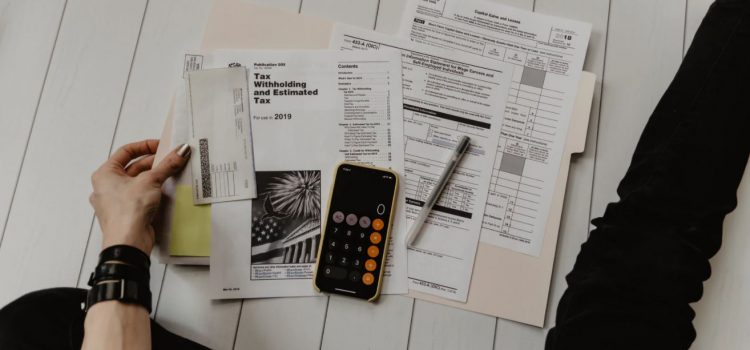

In her book The Deficit Myth, Stephanie Kelton writes that the government doesn’t “earn” money from taxation and doesn’t need the revenue from taxes to finance its spending (because, as a monetary sovereign, it can simply create that money anytime it wishes). So, why do we have to pay taxes?

The government, as the sole source of money, spends first, then taxes and borrows. The government puts money into circulation and then collects some of it back in taxes because money is a useful instrument for spurring the population into doing socially beneficial things.

(Shortform note: Right-libertarian economists would certainly disagree with Kelton’s ideas on the role of taxation in a modern society. According to economic theorists like Murray Rothbard, the entire concept of taxation represents nothing more than an infringement upon individual liberty and private property. These economists argue that taxation is legalized theft, because if you refuse to pay your taxes, the full force of the state will be brought to bear upon you, with the resultant loss of property and freedom (because you’ll go to jail). They argue that we only accept this forcible confiscation of property because we have been conditioned by society that the government is entitled to claims on the things we own.)

So if the government doesn’t need the tax money, then why do we need to pay taxes? Kelton argues that the government wants a productive, high-value economy that encourages people to earn and invest. So it creates taxes to spur the demand for dollars (because you need to earn the dollars to be able to pay the tax), which gives people and businesses an incentive to do things that create value for the economy and society.

In addition to spurring economic activity, Kelton writes that a progressive, well-designed tax system can help reduce inequality and steer social policy in a progressive direction that leads to better and healthier outcomes for society. For example, taxing industrial pollution makes it more expensive for companies to damage the environment by dumping waste into the community’s air and water—creating an incentive for them to use more efficient and sustainable production processes that create less waste.

Is Progressive Taxation Counterproductive?

Some economists have argued that progressive taxation of the sort championed by Kelton is actually not effective at reducing income inequality—and may actually make it worse. According to the Federal Reserve Bank of St. Louis, progressive taxes do increase the disposable income of lower-income people. But it’s what happens after that that undermines their effectiveness. Lower-income individuals and households are much more likely to work for fixed wages. But higher-income individuals and households derive a larger share of their income from ownership of capital—such as businesses, stocks, bonds, and real estate. This means that, when the progressive tax is implemented, low-income individuals and households will go and spend their extra money at the businesses owned by the wealthy, which increases the latter’s earnings, dividends, and stock prices.

On top of that, those wealthy households, businesses, and individuals would then take their extra earnings and spend them at businesses owned by other wealthy parties. The overall effect is that the redistributed income from the progressive tax ends up being earned, spent, and re-spent by high earners.

———End of Preview———

Like what you just read? Read the rest of the world's best book summary and analysis of Stephanie Kelton's "The Deficit Myth" at Shortform .

Here's what you'll find in our full The Deficit Myth summary :

- A look at national debt through the lens of Modern Monetary Theory

- How public discourse about national debts and deficits gets the facts wrong

- Why MMT says the U.S. government could finance any program it wishes to create