This article is an excerpt from the Shortform book guide to "Flash Boys" by Michael Lewis. Shortform has the world's best summaries and analyses of books you should be reading.

Like this article? Sign up for a free trial here .

What is high-frequency trading? How does it influence the stock market?

High-frequency trading is considered an unfair method that uses algorithms to execute stock orders on the market in a matter of seconds. Michael Lewis, the author of Flash Boys, says that many firms on Wall Street have been known to use the method to gain more money for themselves, even though they preach that the stock market is fair game.

Continue reading to know what high-frequency trading is and how the trend spiraled with electronic trading.

What Is High-Frequency Trading?

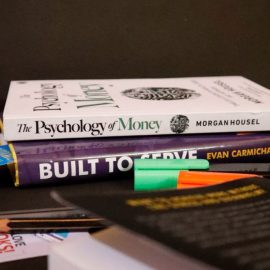

What is high-frequency trading? Lewis describes high-frequency trading (HFT) as a type of electronic trading platform that uses automated computer algorithms to very quickly buy and sell large quantities of stocks. High-frequency (HF) traders and firms own these high-powered computers and algorithms. These HFT algorithms gather market data and use this information to buy and sell stocks, completing this process in microseconds, or one-millionth of a second, thus using a different strategy than long-term buy-and-hold investing positions. This speed advantage makes HFT algorithms faster than any human trader, giving them a powerful edge over traditional investors and traders by enabling them to accrue billions of dollars through HFT trades that traditional investors and traders can’t.

(Shortform note: Lewis answers what high-frequency trading is, but not its origins. While Lewis doesn’t detail the history of high-frequency trading, who started it, or when it started, this may be because experts don’t agree on how it started. Experts have traced the practice back to the 1830s, 1930s, 1970s, and 2005. Some researchers attribute HFT’s creation to former finance professor David Whitcomb, while others believe the SEC’s deregulation of the stock markets started the practice.)

Electronic Trading

Now that we know what high-frequency trading is, let’s look at how it became such a popular and unethical method in the stock market.

The stock market is where investors buy and sell stock, or partial ownership in companies. The stock market is composed of many different stock exchanges, which are individual marketplaces where stocks are traded. The National Association of Securities Dealers Automated Quotations (Nasdaq), the New York Stock Exchange (NYSE), and Better Alternative Trading System (BATS) are all examples of stock exchanges.

Traders and brokers trade stocks on behalf of an investor at a stock exchange, typically doing so as part of investment firms, brokerage firms, or banks. Traders are the financial intermediaries between investors and stock exchanges, and they’re responsible for executing their customers’ orders.

Today, anyone with a computer can access a stock exchange, since stocks are traded electronically, using computer technology to pair buyers and sellers in a virtual market. Lewis explains how both human and computer traders go through the same three steps of an electronic trade:

- Gather market data. This data includes information about different stocks and their current value at each stock exchange.

- Use that data to make a smart trading decision. Traders might identify a stock that is low in price worth buying or a stock that could be sold for a higher price.

- Execute an order. Traders follow through with their trading decision and actually buy or sell stock.

Lewis believes that humans are good at this process but asserts that technology is better. Computer programs can complete these steps more thoroughly and much faster than a person can, sending and receiving signals about market data in a fraction of the time it takes you to blink your eyes. If a trader has an extra split second to evaluate stock information, they have a slight advantage over other traders. This is how high-frequency trading became a problem in the market.

Lewis says HFT uses electronic trading’s unique characteristics to unfairly disadvantage regular investors: speed, dark pools, rebates, new regulations, order types, and proprietary trading.

Electronic Versus Algorithmic Versus High-Frequency Trading

While Lewis discusses electronic trading, he doesn’t differentiate between electronic trading, algorithmic trading, and HFT. Electronic trading involves creating an online brokerage account to facilitate electronic transfers between you and the brokerage. After placing an order, the brokerage uses its technology to interact with stock exchanges to execute trades.

While someone can make an electronic trade, someone can only write the code for an algorithmic trade. With algorithmic trading (also called automated trading, black-box trading, or algo-trading), a computer algorithm—a defined set of instructions—places a trade. The trade, in theory, can generate profits at a speed and frequency that is impossible for a human trader to do—this is HFT, or the most common kind of algorithmic trading. Lewis’s focus is HFT, which is probably why he doesn’t detail the other kinds of algorithmic trading.

Who Brought Attention to High-Frequency Trading Problems?

In the late 2000s, in the years leading up to Aleynikov’s trial, a Canadian trader with the Royal Bank of Canada (RBC), Brad Katsuyama, was starting to notice changes in the stock market that clued him into systemic problems caused by high-frequency trading. While Katsuyama wasn’t the first person to learn about HFT and its tactics, he was one of the first to ask what high-frequency trading is and raise awareness that it was a problem.

While working at RBC, Katsuyama noticed that he couldn’t trade successfully anymore, because in the time between sending out his customers’ orders and actually buying stocks, the stock market would change, forcing him to pay more money. Katsuyama asked RBC executives for permission to investigate why he was losing money in his trades, and they agreed.

Katsuyama Starts Investigating

Lewis explains that Katsuyama first learned about HFT when HFT executives asked RBC to provide them with access to the Canadian stock market. Katsuyama thought this was a bad idea, since he couldn’t find anyone who could explain HFT to him, and he suspected that HF traders might be the reason why he was paying more for his trades.

Katsuyama assembled a team to help him investigate the practice. He recruited Ronan Ryan, a telecommunications expert who helped trading firms increase their signal speed. After pooling their knowledge, Katsuyama and Ryan met with different Wall Street executives, educating them about how HFT tactics exploited the stock market.

Katsuyama also added John Schwall to his team. Schwall was a product manager, the intermediary between programmers and traders. Soon after joining the team, Schwall investigated the history of the stock market and its regulations. This information supplemented Katsuyama’s knowledge of the stock market, its conditions, and how HFT exploited those conditions.

———End of Preview———

Like what you just read? Read the rest of the world's best book summary and analysis of Michael Lewis's "Flash Boys" at Shortform .

Here's what you'll find in our full Flash Boys summary :

- Why high-frequency trading (HFT) is a threat to your investments

- A look at Wall Street’s greedy response to HFT

- How Canadian trader Brad Katsuyama tried to fight the problem