This article is an excerpt from the Shortform book guide to "The Warren Buffett Way" by Robert G. Hagstrom. Shortform has the world's best summaries and analyses of books you should be reading.

Like this article? Sign up for a free trial here.

What did Warren Buffett learn from Benjamin Graham? How did the 1929 stock market crash impact their investment mindset?

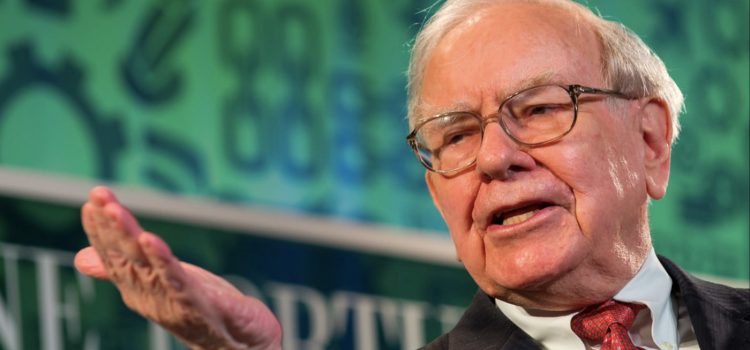

In The Warren Buffett Way, Robert G. Hagstrom discusses the ways Buffett was influenced by his teacher Benjamin Graham. Warren Buffett learned about value investing from Graham, and Buffett embraced his teacher’s numbers-driven approach to evaluating companies.

Read more to understand what Buffett picked up from Graham.

Warren Buffett & Benjamin Graham

Hagstrom discusses the early influences of Warren Buffett. Benjamin Graham’s investing classic, The Intelligent Investor, persuaded Buffett when he studied under Graham at Columbia Business School. In particular, Hagstrom argues that Graham showed Buffett the merits of value investing, which involves purchasing companies’ stock for less than its true value. Because Graham developed value investing in the wake of the stock market crash of 1929, its key tenets are diametrically opposed to the reckless speculation that drove the stock market crash—a crash that occurred because investors assumed the stock market could only rise, leading to widespread speculative investing.

To understand this approach to investing, we first need to understand the distinction between a company’s share price and its intrinsic value. Share price, quite simply, refers to the actual price of one share of a company’s stock—for example, at the beginning of 2023, one share of Tesla stock cost $118.47.

(Shortform note: One fact that complicates our ability to track a stock’s value is that even on a day-to-day basis, share price is volatile, meaning that it experiences swings. Indeed, most stocks swing approximately one percent in either direction on a given day, while some stocks can even experience five percent swings or greater in a single day.)

Hagstrom notes, however, that intrinsic value is harder to define. Roughly put, the intrinsic value of a company’s stock is the fair value of that stock, assuming all relevant information was known. To illustrate, if excessive optimism had led investors to aggressively buy Tesla stock at the start of 2023, rapidly increasing its stock price, then it’s possible that Tesla’s intrinsic value was lower than its share price of $118.47.

For his part, Graham points out that, if you buy stock at a discount to its intrinsic value, you’ve gotten a good deal on the stock. Moreover, he argues that because a company’s share price tracks its intrinsic value over the long term, value investing makes it likely that you’ll profit on your investment as the discounted share price increases to match its intrinsic value. For instance, if Tesla was undervalued at $118.47, at which point you chose to invest in it, then you’ll ultimately profit when the market adjusts its share price to match its intrinsic value.

(Shortform note: Like Graham, many investors assume that intrinsic value is a real entity, but it bears mentioning that some experts disagree. Indeed, certain economists argue that there is no such thing as intrinsic value because goods are only valuable to the extent that consumers will pay for them. For example, in the case of precious metals like gold and silver, they argue that these metals were valuable historically because we used them as currency, not because they possess intrinsic value. Likewise, they reason that stocks are only valuable to the extent that consumers are willing to pay for them, which means that in practice, stock prices may never actually catch up to their supposed intrinsic value.)

Hagstrom notes that, although Graham’s influence is most evident in Buffett’s approach to value investing, it also shaped Buffett’s preference for quantitatively analyzing companies’ finances—typically over a five-year time frame since financial data are volatile on a yearly basis. In particular, Hagstrom explains that Buffett seeks companies that have a high return on equity, owner earnings, profit margins, and ratio of retained earnings to share value, metrics that indicate good financial health.

———End of Preview———

Like what you just read? Read the rest of the world's best book summary and analysis of Robert G. Hagstrom's "The Warren Buffett Way" at Shortform.

Here's what you'll find in our full The Warren Buffett Way summary:

- How to invest like Warren Buffett and earn above-market returns

- How to assess companies to identify which ones to invest in

- Tips for managing your portfolio and avoiding psychological mistakes