This is a free excerpt from one of Shortform’s Articles. We give you all the important information you need to know about current events and more.

Don't miss out on the whole story. Sign up for a free trial here .

What is the CHIPS (Creating Helpful Incentives to Produce Semiconductors and Science) Act? How will it help U.S. manufacturers?

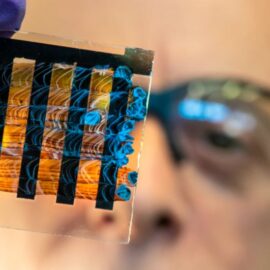

Chips are essential to all the tech we rely on every day, from our smartphones to our cars. Once upon a time, the U.S. produced those chips, but today they mostly come from Taiwan or China—however, the CHIPS Act may reverse that trend.

Read on to learn more about the CHIPS Act and the state of the chip industry today.

The U.S. Falls Behind in the Chip Industry

The U.S. has fallen behind in its leadership of the chip industry because Asian countries have invested more in incentivizing the industry through tax policy. However, the recently passed CHIPS (Creating Helpful Incentives to Produce Semiconductors and Science) Act seeks to reverse that trend with a $52 billion investment.

The chip industry is intricate, and the U.S. still leads some of its components, such as the software and machinery used to design and manufacture chips. In fact, the U.S. is not shy about leveraging its leadership in that area to shut China out of the chip industry, as it has done recently with the sanctions President Biden announced against China. These sanctions block Chinese companies from accessing the American technology they need to produce semiconductor chips.

But despite the United State’s leadership of that piece of the chip puzzle, the Taiwan Semiconductor Manufacturing Company (TSMC) is the indisputable leader in chip manufacturing, producing 90% of the world’s chips. A decade ago, that leader was Intel, but it has fallen dramatically behind in technological innovation.

As mentioned previously, part of the reason the U.S. has fallen behind in leadership of the chip industry is that Asian countries have invested more in incentivizing the industry through tax policy. This has made manufacturing a more profitable business in that region of the world.

What Does the CHIPS Act Promise? And Where Does it Fall Short?

The recently passed CHIPS Act seeks to reverse that trend with a $52 billion investment in the semiconductor industry by filling the funding gap in the “valley of death” between research and mature commercial technologies, both of which are already successful in the U.S.

The act includes:

- $39 billion to incentivize semiconductor manufacturing

- $11 billion for the Department of Commerce to allocate for chip R&D

- $2 billion for the Defense Department

It also bans the export of advanced chips to China for 10 years and imposes controls on other technologies. The target is clearly China’s nascent semiconductor industry, but Asian allies such as South Korea are also indirectly affected since many of their companies’ manufacturing facilities are in China.

By reshoring the semiconductor industry, the act promises to make the U.S. more resilient in future crises, and bring back manufacturing jobs in the process.

However, some argue that the CHIPS Act is not enough:

- The $39 billion set aside for incentives for semiconductor manufacturers amounts to little when you consider how expensive it is to set up a chip-manufacturing facility in the U.S. compared to Asia.

- The process of building up manufacturing capacity will take years, and the U.S. will continue to rely on Taiwan and compete with China during that time.

- The supply chain as a whole needs to be reshored in order to truly make the U.S. independent. So far, the CHIPS Act is focused on fabs—factories that assemble transistors on silicon wafers—but this is only one step of the semiconductor manufacturing process. Some argue that it’s imperative to bring as much of the automated manufacturing to the U.S. as possible and support allies in the Americas such as Mexico and Brazil to set up the more labor-intensive facilities. This would at least bring the entire supply chain closer to the U.S.

- There is not enough qualified labor in the U.S. to bring the semiconductor industry back. To help fill crucial roles, tech companies are lobbying Congress to pass laws revising immigration programs for foreign professionals with advanced degrees. A previous version of the CHIPS Act included provisions that would have made it easier for foreign professionals to get visas, but that provision was scrapped when the bill moved from the House to the Senate.

Want to fast-track your learning? With Shortform, you’ll gain insights you won't find anywhere else .

Here's what you’ll get when you sign up for Shortform :

- Complicated ideas explained in simple and concise ways

- Smart analysis that connects what you’re reading to other key concepts

- Writing with zero fluff because we know how important your time is