This article is an excerpt from the Shortform book guide to "The Automatic Millionaire" by David Bach. Shortform has the world's best summaries and analyses of books you should be reading.

Like this article? Sign up for a free trial here .

How much money do you set aside towards your retirement savings? What can you do to minimize how much taxes eat away from your retirement fund?

According to David Bach, the author of The Automatic Millionaire, you need to contribute to your retirement account before you pay your taxes to make the most out of your income. You can achieve this by using a tax-deferred retirement plan—a plan that allows you to send money to your retirement account without having to pay tax on it.

In this article, you’ll learn how paying taxes impacts your retirement savings, and how you can minimize this impact by opting for a tax-deferred retirement plan.

How Paying Taxes Impacts Your Savings

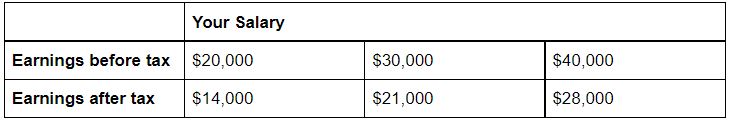

The government takes approximately 30 cents per dollar of your salary as tax before the money is sent to your checking account. To illustrate how this impacts you, the following chart lists what you earn both before and after-tax (assuming you pay 30% tax):

This means that if you intend to contribute 10% of your income towards your retirement, the amount you end up contributing after you pay your taxes is considerably lower than the amount you’d contribute before you pay your taxes.

- For example, if you earn $20,000 and you intend to contribute 10% to your retirement account, you can contribute $2,000 before you pay tax, compared to $1,400 after you’ve paid your tax.

Bach argues that you need to legally bypass the government’s taxation to maximize the earning potential of your retirement fund and get the most out of your earned dollars. You can achieve this by using a tax-deferred retirement plan—a plan that allows you to send money to your retirement account without having to pay tax on it. The following table demonstrates how much you can save and then earn per dollar (based on an annual return of 10%) by choosing to contribute to your retirement before you pay your taxes:

| Pre Tax Retirement Contributions | After-Tax Retirement Contributions | |

| Gross Income | $10 | $10 |

| Minus taxes = | $10 – 0% = $10 | $10 – 30% = $7 |

| + 10% annual return | $10 + 10% = $11 | $7 + 10% = $7.70 |

| Is the investment taxable? | No | Yes |

The Disadvantages of Tax-Deferred Retirement Plans

While using a tax-deferred retirement plan does offer the immediate advantage of paying less tax now so that you can save more money, it may end up costing you more once you retire.

When you withdraw money from a tax-deferred account, it’s taxed as income for the year in which you make the withdrawal—the tax you pay depends on how much you withdraw, the same way that the amount of tax you pay depends on your income. The following list, based on the tax brackets for 2021, shows the amount of tax you’ll pay for withdrawals from your tax-deferred account:

- 10%: up to $9,950

- 12%: up to $40,525

- 22%: up to $86,375

- 24%: up to $164,925

- 32%: up to $209,425

- 35%: up to $523,600

- 37%: over $523,600

This means that the more money you withdraw from your tax-deferred account, the more tax you pay after you retire. If you intend to withdraw large amounts of money to fund a dream vacation, pay for a family wedding, or cover unexpected expenses, you may end up paying more tax than you would’ve when you originally earned the money.

If you expect to have high expenses after you retire, there are other options to avoid paying taxes on your withdrawals—we’ll cover these later on in this chapter.

———End of Preview———

Like what you just read? Read the rest of the world's best book summary and analysis of David Bach's "The Automatic Millionaire" at Shortform .

Here's what you'll find in our full The Automatic Millionaire summary :

- A simple but powerful action plan for you to quickly automate your finances

- How to grow your finances with just a few dollars a day

- An exploration of why people fail to prepare for their financial futures