This article is an excerpt from the Shortform book guide to "The Man Who Solved the Market" by Gregory Zuckerman. Shortform has the world's best summaries and analyses of books you should be reading.

Like this article? Sign up for a free trial here.

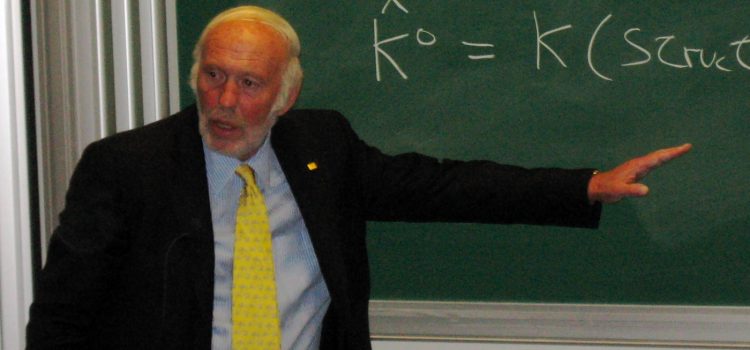

Where did Jim Simons’s love for mathematics come from? How did he turn his childhood passion into a groundbreaking career?

For Jim Simons, mathematics is everything. According to The Man Who Solved the Market by Gregory Zuckerman, Simons thought equations and theorems would be the answer to the universe’s biggest mysteries.

Keep reading to learn more about Simons’s passion for mathematics.

A Love of Mathematics

Jim Simons was born in 1938 to a middle-class Jewish family in Brookline, Massachusetts, a suburb of Boston. Intellectually curious from a young age, writes Zuckerman, Jim Simons discovered an early passion for mathematics. Where some find aesthetic beauty in nature or in great works of literature, Zuckerman writes that Jim Simons found beauty and elegance in mathematics. Jim Simons was inspired by the unity and connection of different fields within mathematics and the idea that formulas, equations, and theorems could be the keys that unlocked the mysteries of the observable universe. He dreamed that solving these mathematical mysteries could point the way toward discovery of deeper, universal truths.

(Shortform note: Some mathematicians argue that there are two forms of mathematical beauty—generic and exceptional. Generic beauty is found in the inherent order and universality of mathematics, such as the infinite extension of integers in a number line. Exceptional beauty, on the other hand, is rooted in the exceptions to or violations of those laws, which evoke a sense of mystery and deep originality. An example of exceptional mathematical beauty is the dodecahedron, a solid built out of 12 pentagons and one of five perfectly symmetric solids, whose shape the ancient Greeks believed symbolized all the heavenly bodies in harmony.)

We’ll explore how this adolescent passion for mathematics influenced his early career in academia, code-breaking for the US government, and financial trading.

An Intellectual Pursuit

As a student, writes Zuckerman, Simons was interested in mathematics purely as an intellectual pursuit. He was motivated by the challenge of solving problems, the thrill of new discoveries, and the exploration of unsolved mysteries. At this age, he had little interest in—or conception of—the application of mathematics to the “real” world or how he could harness it for personal financial gain. Although money and wealth had a certain allure to Simons as a young man, mathematics for its own sake was his abiding passion.

| Pure vs. Applied MathematicsSimons’s passion for math as an intellectual pursuit speaks to a broader division within the field of mathematics—that between pure mathematics and applied mathematics. Pure mathematics is focused on theory—people who engage in pure mathematics work with abstract concepts and theorems. An inquiry-based discipline, pure mathematics seeks to prove theorems or find solutions for unsolved problems, such as the Millennium Prize Problems selected by the Clay Mathematics Institute (solving any one of them can earn a mathematician a $1 million prize from the Institute). Applied mathematics, meanwhile, is about the practical use of those concepts and theorems to solve real-world problems. Applied mathematics employs these concepts in fields from science, to economics, accounting, medicine, and, as we’ll see in Simons’s case, investing. |

Discovering Investing

Zuckerman writes that Simons began to discover the exhilaration and thrill of investing in his early 20s. While completing his doctoral program at the University of California, Berkeley, he made a few preliminary trades by investing in soybean futures.

After earning some initial profits when the price of soybeans skyrocketed, Simons—ignoring a friend’s advice about the volatility of commodities prices—held onto his investment too long and saw his profits evaporate when soybean prices tumbled. But the experience was his first entry into the world of investing that would later define his life—and make his fortune.

Breaking Codes at the IDA

After completing his doctoral thesis at Berkeley in 1962 and publishing his first mathematical paper that year, Simons took a job as a codebreaker with the Institute for Defense Analyses (IDA), a nonprofit research organization with close ties to the United States government.

Working there from 1964 through 1968, at the height of the Cold War between the United States and the Soviet Union, Simons’s job was to sift through reams of coded Soviet messages and signals to identify patterns. Once Simons and his intelligence analyst colleagues could identify the Soviet patterns of communication, they could unlock the meaning of those communications and gain crucial intelligence on Soviet actions—such as where they might be moving troops, diplomatic personnel, or military hardware.

———End of Preview———

Like what you just read? Read the rest of the world's best book summary and analysis of Gregory Zuckerman's "The Man Who Solved the Market" at Shortform.

Here's what you'll find in our full The Man Who Solved the Market summary:

- The story of Jim Simons, one of the most successful hedge fund managers ever

- How Simons' experience as a codebreaker helped him succeed

- How Simons set the stage for today's large-scale, automated trading