This article is an excerpt from the Shortform book guide to "Doughnut Economics" by Kate Raworth. Shortform has the world's best summaries and analyses of books you should be reading.

Like this article? Sign up for a free trial here .

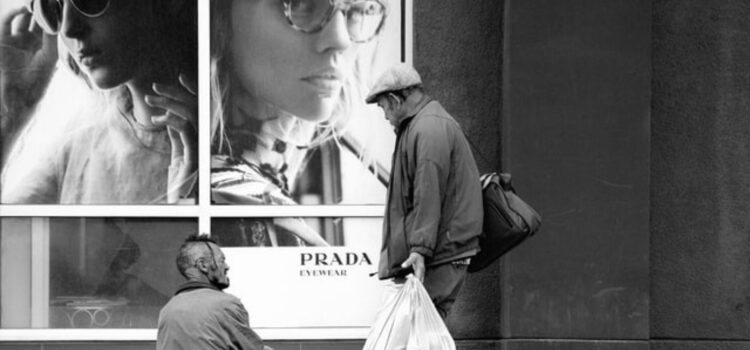

Can income inequality be solved? What can be done to bridge the global divide between the rich and the poor?

Income inequality is a global problem—it plagues all countries to some extent. A small minority of the world’s population has amassed vast fortunes, while billions of people remain mired in extreme poverty. But hope remains. In her book Doughnut Economics, Kate Raworth proposes four income inequality solutions that can reduce the gap between the rich and the poor.

Let’s take a look at Raworth’s solutions for income inequality.

The Distributive Economy

She argues that inequality is directly linked to social ills—like crime, drug abuse, lack of educational attainment, and low life expectancy—and undermines democratic institutions and social cohesion. Moreover, inequality fuels a feedback loop that leads to more inequality, as the wealthy can use their outsized political power to lobby for economic policies that make them even richer—all while fueling wasteful conspicuous consumption that harms our environment and depletes natural resources. Meanwhile, the ability of a few large players to shift the flows of capital throughout the global economy makes the entire system fragile, unstable, and vulnerable to shocks and bubbles.

| Inequality Hurts Economic Growth Some economic research suggests that, in addition to contributing to social dysfunction and destabilizing the global flow of capital, inequality also acts as a drag on economic growth. According to one finding, income inequality, largely driven by the failure of workers’ pay to keep pace with the overall rise in productivity, reduces growth because it shifts spending power away from poorer households toward wealthier ones—and the latter are significantly more likely to save rather than spend. This has the effect of reducing the economy’s aggregate demand. Indeed, this paper estimates that inequality has reduced GDP by 2-4% in recent years below what it otherwise would have been. To address the problem of inequality-fueled stagnant growth, the authors call for an aggressive, deficit-financed fiscal policy of direct cash transfers; more generous social spending; and greater collective bargaining power for workers through trade unions. |

In her book Doughnut Economics, Kate Raworth proposes some concrete income inequality solutions: 1) redistributing land resources, 2) getting the money supply out of the hands of governments and central banks, 3) giving workers greater control over the economy’s production and distribution decisions, and 4) rewarding companies for investing in people rather than robots.

1. Redistributing Land Ownership

To make the economy properly distributive, says Raworth, we need to change who owns property, which is itself wealth-generating. She proposes redistribution of land ownership, giving people an asset they can improve or use as collateral.

She argues that this is fair, because land is often only valuable because of the natural endowments on or near it (which are our collective natural inheritance) or the social improvements made in its vicinity (like roads, schools, and industry), which are paid for by the shared investment and labor of the community.

(Shortform note: Some economists take a dimmer view of redistribution than Raworth. In Capitalism and Freedom, Milton Friedman writes that forced economic redistribution is inherently unjust. He argues that one of the cornerstones of a society based upon voluntary exchange is the right to keep your private property. According to Friedman, there is no moral justification for a majority to compel a minority to hand over its property, whether it’s a gang of armed robbers telling you to hand over the cash in your wallet or a majority of voters passing legislation to legally confiscate wealth from the so-called “1%.”)

2. Democratizing Money

Besides expanding property ownership, Raworth argues that a truly distributive economy needs to democratize the money supply.

She writes that in a capitalist economy, banks create money by lending it out and earning it back with interest, then lending out more, thereby increasing the money supply. Unfortunately, she argues, entrusting banks to do this comes with some problems—private banks will often use this money-creating power to purchase or invest in assets that already exist, driving up their prices and enriching those who already own them (in many cases, the banks themselves). This drains productive resources away from society.

But this is not the way it has to be. Raworth champions government-backed financial institutions that could take the role of private banks, with a social commitment to invest in low-interest loans for enterprises that benefit society: roads, infrastructure, education, skills training, and the environment. The government could also require banks to hold larger reserves of capital, which would stabilize the financial system and reduce the incentive for banks to ignite giant credit-fueled bubbles that melt down the financial system.

(Shortform note: These sorts of banking reforms championed by Raworth are actually quite similar to steps the Obama administration took to stabilize the banking system in the wake of the 2008 financial crisis. In A Promised Land, Obama discusses his team’s plan to conduct a stress test of the major banks—essentially, a thorough financial audit of the banks’ assets and liabilities, conducted by the Federal Reserve. Under the terms of the stress test, banks were required to hold larger stocks of capital in reserve. They could only receive further bailouts if the stress test found that they could not remain solvent without such an infusion of cash.)

She argues that central banks could also take the even more radical step of issuing new money directly to every household during a recession, creating a people’s monetary policy. Moreover, blockchain technologies like Ethereum and Bitcoin can also democratize and decentralize currency through their system of peer-to-peer exchange on a public ledger that removes intermediaries like banks and other financial institutions.

3. Reimagining Labor Markets

The next step Raworth suggests for creating a distributive economy is transitioning to a system of employee-owned firms, giving workers an equity stake in the firms to which they supply their valuable labor.

She notes that workers have seen their share of national wealth and their bargaining power decline precipitously since the dawn of the neoliberal era in the 1970s and 1980s. This has happened to varying degrees all over the world, even in highly unionized economies like Germany and the Scandinavian countries. Most firms see their sole purpose as maximizing shareholder value, with labor merely a cost—one to be minimized as much as possible.

(Shortform note: Perhaps the most well-known articulation of this theory came from economist Milton Friedman. In his famous 1970 article for the New York Times Magazine, “The Social Responsibility Of Business Is to Increase Its Profits,” Friedman championed the shareholder value maximization model. This model held that the most important measure of a company’s success was the financial returns to its shareholders. He saw any acts of “corporate social responsibility” as a misuse and expropriation of shareholders’ money on the part of well-intentioned but ultimately misguided corporate officers.)

But, Raworth writes, shareholder equity only exists because of the labor that adds value to the firm’s products and services. To deny workers that same equity stake is to deprive them of what is rightfully theirs. She proposes rewriting corporate charters to implement new and alternative forms of labor organization, such as cooperatives and employee-owned enterprises that will give workers a greater share of national income and reorient the mission of private enterprise itself—from being profit-driven to people-driven.

4. Adapting to Automation

Finally, Raworth writes that building a people-centered economy requires addressing the challenges of automation.

The economy’s productivity is no longer linked to employment—firms can produce more output with fewer workers, largely thanks to automation. Raworth notes that the trend is no longer confined to blue-collar manufacturing jobs. Even white-collar professional “knowledge economy” work is increasingly being cannibalized by software and AI. This presents a major social problem as an ever-growing share of the population may find itself without any useful labor to sell.

Raworth proposes using the tax code to shift the incentives for businesses. Right now, businesses have to pay payroll taxes for human workers, but can write off investments in robots and other automation technology as a business expense—the government is, in effect, subsidizing automation. Raworth recommends taxing automation and rewarding firms for investing in humans.

She also champions giving citizens a stake in the private gains accrued by technology companies—gains that are often only possible because of the initial public investment in the underlying technologies. Raworth writes that this could take the form of public redistributed royalties from companies that benefited from taxpayer investments or from their use of public assets.(Shortform note: Although Raworth proposes giving the public a stake in technology companies because of historical government investments in technology, she doesn’t acknowledge just how far-reaching the implications of this could be. Using her logic, any company that harnesses the technology of the internet—which, today, is all companies—would have to cede an equity stake to the government. This is because the technology that created the internet itself traces its earliest roots to US government research in the 1960s, when Pentagon analysts created ARPANET—the protocol that formed the base of today’s internet.)

———End of Preview———

Like what you just read? Read the rest of the world's best book summary and analysis of Kate Raworth's "Doughnut Economics" at Shortform .

Here's what you'll find in our full Doughnut Economics summary :

- Why we need a top-to-bottom redesign of our global economic order

- Why long-term economic growth is unsustainable

- How inequality fuels a feedback loop that leads to more inequality