This article is an excerpt from the Shortform book guide to "The Future Is Faster Than You Think" by Peter H. Diamandis and Steven Kotler. Shortform has the world's best summaries and analyses of books you should be reading.

Like this article? Sign up for a free trial here.

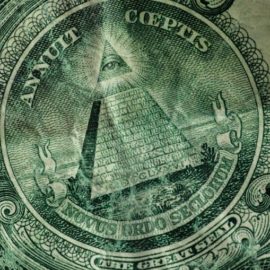

What’s the future of digital currency? Will we ever stop using banks?

For centuries, banks have been in charge of our money. However, there’s a good argument that this may change in the future.

Here’s why digital currency will be how we transfer and store money in the near future.

Money in the Future

In their book The Future Is Faster Than You Think, Peter H. Diamandis and Steven Kotler argue that with the advent of digital currencies and blockchain technology, banks will no longer be critical to our financial dealings. Instead, money and finance will become increasingly decentralized and personalized as the future of digital currency.

The authors explain that a digital currency is a type of money that only exists online. Digital currencies, like Bitcoin, allow people to make real-time transactions directly with one another without a bank’s involvement. This has a host of benefits, according to the authors. For example, digital currencies provide people without bank accounts a way to store money, and they save people money by eliminating bank transaction fees.

| Why Bitcoin is a Good Money Like Diamandis and Kotler, many experts see cryptocurrencies playing a large role in the future of finance. In The Bitcoin Standard, Saifedean Ammous argues that bitcoin in particular has the potential to become a new international monetary standard—a modern equivalent of gold. Traditional currencies (like dollars and euros) are controlled and manipulated by governments and financial institutions, which can lead to issues like inflation and economic instability. On the other hand, Ammous sees bitcoin as a good form of money because it’s beyond government control and has good salability. It’s also finite like gold (only 21 million bitcoins can ever be mined), so it won’t lose value due to inflation like paper money and fiat currencies that can be continually printed. |

The underlying technology that makes digital currency possible is called a blockchain, which Diamandis and Kotler explain is essentially a massive digital ledger that verifies and records bitcoin transactions using a secure network of computers. Every transaction ever made adds a “block” to existing blocks, resulting in a chain that anyone can review. This makes it more transparent than traditional banking systems.

(Shortform note: Blockchain technology is not just the cornerstone of cryptocurrencies—it’s used in many industries beyond finance as well—from health care to media and entertainment. For instance, Fishcoin uses blockchain to share every point along the seafood supply chain to promote transparency and traceability from source to consumer. In doing so, the developers hope to improve sustainability in the seafood industry.)

The authors add that AI will further refine these new financial systems. AI could give us personalized financial advice, helping us make better decisions about our money without a financial adviser. AI can also make peer-to-peer loans and transactions safer by checking a person’s background and generating an accurate picture of their trustworthiness.

(Shortform note: Other experts caution that before AI can be considered an effective financial adviser, it must first overcome several limitations. One of these limitations is that AI tools often exhibit overconfidence and biases, similar to human behavior. Financial advisers are skilled at helping clients avoid mistakes caused by behavioral biases, but AI tools currently struggle with this. Furthermore, AI tools are still inconsistent and not always accurate, which makes them somewhat unreliable at this stage.)

———End of Preview———

Like what you just read? Read the rest of the world's best book summary and analysis of Peter H. Diamandis and Steven Kotler's "The Future Is Faster Than You Think" at Shortform.

Here's what you'll find in our full The Future Is Faster Than You Think summary:

- Why change and technological progress are occurring at breakneck speed

- How cutting-edge technologies will revolutionize the ways we live and work

- How entertainment will change from being passive to active