This article is an excerpt from the Shortform book guide to "Evicted" by Matthew Desmond. Shortform has the world's best summaries and analyses of books you should be reading.

Like this article? Sign up for a free trial here.

Why are eviction rates rising in the United States? Why is the poverty-eviction cycle so hard to break? Can anything be done to help the situation?

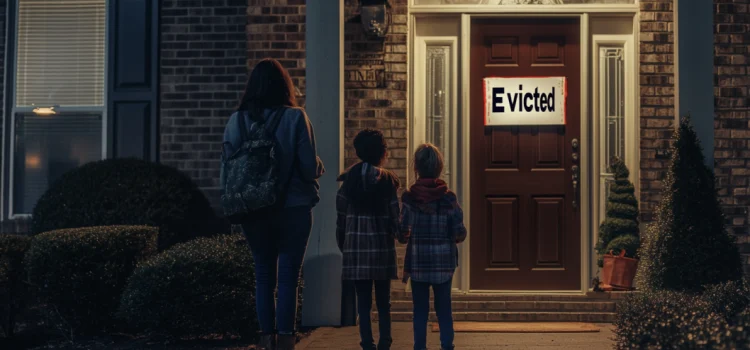

Imagine living with the knowledge that you could lose your home at any time, for any reason. In Evicted, sociologist Matthew Desmond explains that millions of Americans live every day under the threat of eviction, and it takes a heavy toll on them both psychologically and financially.

Keep reading for our brief overview of Desmond’s book Evicted.

Overview of Evicted: Poverty and Profit in the American City

Imagine living with the knowledge that you could lose your home at any time, for any reason, and have to find a new place to live at a moment’s notice. In his book Evicted, Matthew Desmond explains that millions of Americans live every day under the threat of eviction, and it takes a heavy toll on them both psychologically and financially. Evicted also explains the numerous ways that poverty and eviction reinforce each other, creating a cycle that traps people for life.

While researching Evicted, Desmond spent a year living in a Milwaukee trailer park and spoke with many low-income tenants living under the threat of eviction. He recorded their experiences, as well as his own, to provide unique insights into what it’s like to live in poverty under an exploitative landlord. Desmond won a Pulitzer Prize for Evicted (2016), and his next book Poverty, by America (2023) became a #1 New York Times bestseller.

Desmond is a professor of sociology at Princeton University. He’s also the founder and Principal Investigator of Eviction Lab, an organization that collects and freely shares data about evictions in the United States. Desmond has also written several books about racial discrimination in the United States.

This guide will start by explaining why Desmond believes evictions are out of control in the US today and how that came about. We’ll then discuss how poverty leads to eviction and eviction leads to poverty, creating a cycle that’s nearly impossible to break out of. Next, we’ll explore the roles of predatory landlords and racial discrimination in the cycle of poverty and eviction, then conclude with a few of Desmond’s ideas about how the US could empower its citizens to break that cycle permanently.

Our commentary will provide additional background information about poverty and eviction—both historical information about how we got to the current situation and statistical information showing how these issues impact people in the US today. We’ll also examine the pros and cons of some potential solutions, such as expanding welfare and housing voucher programs. Finally, we’ll present some counterpoints to Desmond’s ideas from more fiscally conservative schools of thought, focusing on individual opportunity and personal responsibility instead of Desmond’s focus on systemic problems and solutions.

The US Is Experiencing an Eviction Epidemic

Desmond begins by saying that evictions in the United States are more common now than they’ve ever been—not even the Great Depression saw eviction rates as high as today’s.

In this section, we’ll discuss two major causes of this eviction crisis: low wages and the loss of solidarity among renters.

Reason #1: Wages Don’t Match the Cost of Living

Desmond says one major reason evictions are so common now is that income hasn’t kept pace with the cost of living: As rent, utilities, and other necessities have become more expensive, wages have remained stagnant for the US’s poorest people. As a result, low-income earners often struggle to pay their rent.

To highlight this problem, Desmond explains that a standard benchmark for living comfortably is that rent should cost less than a third of a family’s income. By contrast, low-income families might spend anywhere from 50% to 70% of what they earn on housing, leaving very little for food and other essentials.

Furthermore, saving money isn’t possible with such a tight budget. This means that any unexpected or unusual expense—such as an emergency room visit or a car repair—can cause low-income families to fall behind on rent, leading to eviction.

Welfare Benefits Aren’t Enough

Desmond adds that government benefits for low-income families, collectively called welfare, have stagnated just like wages have. As a result, these programs—which are designed to help people live comfortably while unemployed or underemployed—now provide barely enough for people to survive.

The author adds that because welfare benefits are means-tested (only available to people with less than a certain amount of money and assets), those benefits discourage people from saving money even if they’re able to. In other words, someone with low-income work and welfare benefits might actually be able to start saving; however, if at any point they have too much in their bank account, they won’t be able to collect benefits anymore. As a result, they’d soon end up in an even worse financial situation than before.

Reason #2: Lack of Solidarity Among Renters

The second reason Desmond gives for evictions happening so frequently is that renters no longer stand up for each other.

He explains that even during the Great Depression, evictions were relatively rare because renters responded to them with large-scale protests. Renters would organize to protect each other because they had a sense of solidarity toward one another. That solidarity stemmed from feelings of shared ownership in their neighborhoods and homes.

By contrast, Desmond says that many people today—even those in low-income households—consider poverty and eviction to be the rightful consequences of personal failings such as laziness or bad decisions. In other words, people blame individuals (including themselves) for their problems, instead of recognizing the systemic failures that trap people in bad situations.

Along with overlooking the systemic problems keeping them in poverty, many renters now view landlords in a positive light: They’re just grateful to have housing, rather than angry about being exploited by predatory renting practices. We’ll discuss those practices and how they came about in the next section.

The author adds that renter solidarity has also fallen apart because low-income renters are now too busy with their day-to-day problems to fight back against the root causes of those problems. For instance, someone who has to work two or three jobs just to survive probably won’t have the energy to protest for higher wages, even though better pay would allow them to work less and live more comfortably.

Poverty and Evictions Create a Vicious Cycle

Naturally, poverty is a major cause of evictions—however, Desmond says that eviction also causes or worsens poverty. This happens because eviction disrupts people’s lives and finances, making things even more difficult for those who were already struggling. As a result, many low-income people find themselves trapped in a cycle of poverty and evictions that can be nearly impossible to break out of.

Scrambling to find a new place to live is already difficult and stressful, but the author says that eviction creates problems well beyond that. First and foremost, people are likely to miss work or benefits appointments while searching for a new apartment. If they can’t find anything in the same area, they’ll probably lose their job entirely.

Second, people with evictions on their record have an even harder time finding someplace new to live, because most landlords will view them as an unacceptable risk. This drives them to seek housing with landlords who specialize in exploiting low-income renters—we’ll discuss these predatory landlords in the next section.

Desmond adds that desperate people may turn to stealing and other criminal activity to make ends meet. However, having a criminal record makes it even more difficult to find housing and work in the US, which further perpetuates this cycle. Therefore, many former prisoners have no choice but to go right back to crime after getting out of prison.

Psychological Impacts of the Poverty-Eviction Cycle

Desmond says that the cycle of poverty and eviction also causes serious harm to people’s mental and emotional well-being. In fact, eviction often leads to clinical depression and even suicide. There are several reasons for this.

First of all, not having a stable home is extremely stressful. Low-income renters live with the constant threat of losing their homes and possessions, which causes them a great deal of anxiety. Second, people who move frequently don’t get the chance to form strong bonds in their communities, which leaves them feeling isolated and vulnerable. These effects are especially pronounced in families with children, where parents have to worry about keeping their children clothed, fed, and in school on top of everything else.

The author also says that bad living conditions, such as squalid apartments and frequent moves, are extremely harmful to self-esteem. People who live in those conditions for a long time start to feel like they’re supposed to live that way. They come to believe that they shouldn’t have decent housing, for reasons that might range from personal shortcomings to the will of God.

Predatory Landlords Prioritize Money Instead of People

Desmond says that predatory landlords are another major factor in the poverty and eviction cycle. Predatory landlords target low-income people and other vulnerable demographics, extract as much wealth as possible from them, then evict them once they start missing rent payments. Now that many people are landlords as their full-time job, these exploitative practices have become more common because professional landlords are seeking to maximize their profits.

To give some examples, predatory landlords often neglect needed repairs and maintenance because they want to spend as little money as possible. They’ll also frequently make verbal agreements with tenants who can’t pay rent, promising to accept only a portion of the rent or labor in exchange for the money they can’t pay—then, after getting what they can from the tenants, the landlords will evict them anyway.

The author provides some background by explaining that the concept of a professional landlord is relatively new—in the past, most landlords were simply people who decided to make some additional money by renting out their unused property. The 2008 housing crisis accelerated the move toward professional landlording: People bought up foreclosed properties at a fraction of their value and turned them into rentals for low-income families.

Landlords Hold All the Power

It may seem counterintuitive to target low-income people in order to make money, but Desmond explains that it works because low-income people are effectively trapped: Their only choices are to be exploited or to be homeless.

Predatory landlords take advantage of their tenants’ vulnerability by threatening them with eviction if they cause any trouble, such as arguing with the landlord or reporting code violations. The landlord might simply decide that the family is too disruptive and evict them.

Renters with higher incomes aren’t nearly as vulnerable to exploitative landlords, because they have the resources to leave and find better housing.

Finally, Desmond says that low-income renters often have little to no legal recourse against predatory landlords. Even if a renter can find a lawyer who’s willing to represent them for free, they can’t afford to take the time off from work to appear in court, so they have no opportunity to plead their case or defend themselves.

Discrimination Is Illegal, but Still Very Common

Poverty and eviction can happen to anyone, but Desmond says that minorities—especially Black people—are disproportionately affected by them.

The Civil Rights Act of 1968 made housing discrimination illegal, meaning that landlords couldn’t reject people on the basis of race or create racially segregated neighborhoods; it also prohibited discrimination based on sex, nationality, and religion. However, housing discrimination persists in numerous ways.

Desmond explains that although it became illegal to explicitly discriminate based on people’s demographics, landlords could accomplish the same thing using perfectly legal screening procedures. For a small fee, landlords can obtain a person’s criminal record, eviction history, credit score, and other information allowing them to decide whether that person is worth renting to. Because of the numerous disadvantages that Black people and other minorities face—which we’ll explain in more detail in the next section—these screening practices hurt minorities by locking them out of many opportunities that their white neighbors can take advantage of.

Furthermore, most of the same landlords who rejected low-income people also rejected people with criminal records, especially violent criminals. As a result, over decades and with landlords making countless such decisions, modern American cities became strongly segregated: Wealth and safety became concentrated in certain areas, poverty and violent crime in others.

Desmond adds that discrimination is a self-perpetuating problem. The people who are forced to live in poor neighborhoods have reduced access to education, healthcare, and other necessities. As a result, it’s unlikely that they or their children will ever be able to improve their situation—they’ll be stuck in the same low-wage jobs (or have no jobs at all), using every resource they have just to stay alive.

The History of Racial Discrimination

So far we’ve discussed how screening led to segregation between advantaged and disadvantaged people, but not the racial component of that process. Desmond explains that racism is built into the systems of landlording in the US, and he traces that racial discrimination from slavery in the 1800s up to the present day.

A (very) brief history of post-slavery discrimination in the US includes:

Sharecropping: When the slaves went free after the Civil War, they quickly found that white people still owned nearly all the land, and they had no choice but to go back to work for them as sharecroppers instead of slaves. Instead of payment, workers received a share of what they grew (hence the name sharecropper), giving them no means to leave and seek better opportunities elsewhere.

The Great Migration: In the early 20th century, Black families moved in huge numbers to cities in the northern US. Since most of them had no money to buy their own homes, they had no choice but to allow landlords to pack them into dilapidated inner-city neighborhoods, which came to be called ghettos.

The New Deal: US President Franklin D. Roosevelt’s New Deal (a comprehensive economic program enacted from 1933 to 1939) was hugely beneficial to white families, many of whom became homeowners for the first time ever, but Black families were largely left out of these federal programs. The government decided that ghettos were too risky for insured mortgages, and denied them; in other words, centuries of discrimination provided the justification for continued discrimination.

After that came the Civil Rights Act of 1968, the failures of which we’ve already discussed. Desmond sums this up by saying that even though the law now requires people to be treated equally, the history of inequality in the US means that Black people and other minorities are still at a significant disadvantage.

Epilogue: The Eviction Epidemic Can Be Cured

Having explained the causes and effects of widespread evictions, Desmond concludes by saying that this problem can be solved; that every US citizen can (and should) have a stable home. In fact, he says, simply expanding federal programs that already exist would go a long way toward accomplishing that goal.

Here are a few of Desmond’s suggestions:

1. Expand housing voucher programs and public housing. Rental assistance programs are the single most effective anti-poverty measure in the US today. Whether the government owns the property (public housing) or provides vouchers that cover part of a tenant’s rent to another landlord, these programs allow people to spend less than a third of their income on housing, freeing up the rest for food, medicine, and other necessities. However, these programs aren’t funded well enough to help everyone who needs them.

2. Establish rent controls. Part of the reason why existing voucher programs don’t help as many people as they could is that landlords overcharge voucher holders on rent, knowing that the government will pay the bill for them. Therefore, an expanded voucher program without corresponding rent controls would be very inefficient—in essence, it would mean using taxpayer money to boost landlords’ profits.

3. Provide public funding for tenants in eviction court. Remember that a large part of why low-income renters allow themselves to be exploited is that they simply can’t afford to go to court and fight back. Federal funds to make up for missed work, childcare, and legal fees would help ensure that tenants can defend themselves against predatory landlords.

Finally, Desmond anticipates the argument that these programs would cost far too much to be feasible. He says that the net cost will probably be far lower than many people think because such programs will greatly reduce costs associated with homelessness, illness, and other effects of poverty.

Desmond adds that the federal government already spends far more than would be needed for a universal housing program but does so in the form of tax benefits for people who already have personal wealth and their own homes. Therefore, he says that the US government could solve the eviction and homelessness crises fairly easily; it just requires using federal funds to help the people who need it most.

Exercise: Reflect on the Eviction Epidemic and Possible Solutions

Now that you’ve read Desmond’s account of the causes and effects of eviction, examine your thoughts about evictions, the people who suffer from the poverty-eviction cycle, and how the US could solve this problem most effectively.

- What, if anything, did you find particularly shocking about evictions in the US? For instance, maybe they’re much more common than you thought, or you didn’t realize how seriously eviction impacts people’s well-being.

- Having read this guide, what are your current feelings about the hardships faced by low-income renters, especially the cycle of poverty and eviction that Desmond describes? For example, do you agree with Desmond that low-income people need and deserve help, or do you believe that getting out of poverty is their own responsibility? Alternatively, perhaps you feel sympathetic but still don’t think it’s feasible to help them.

- Do you agree with Desmond’s proposed solutions to the eviction crisis, such as housing vouchers? Why or why not?

- What other thoughts do you have about how the US could, or should, address its eviction epidemic? For instance, you might have an idea for another federal program to help low-income renters; conversely, you might suggest that the best solution is for the government to stop interfering at all.

———End of Preview———

Like what you just read? Read the rest of the world's best book summary and analysis of Matthew Desmond's "Evicted" at Shortform.

Here's what you'll find in our full Evicted summary:

- Why the rate of evictions in the US is even higher now than it was during the Great Depression

- How poverty and eviction each lead to the other

- Ways we can empower citizens to break the cycle of poverty and eviction