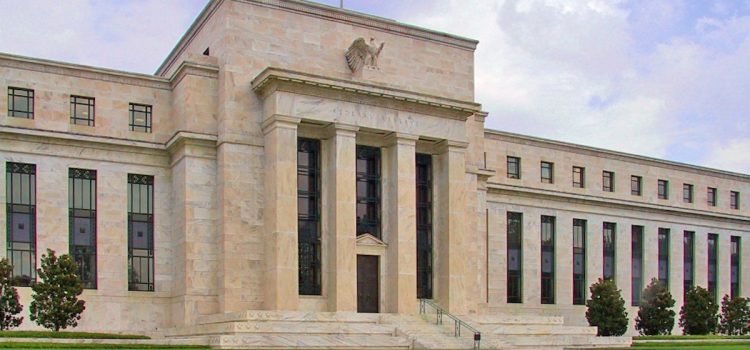

What does the current refinancing boom mean for homeowners? Why are mortgage applications hitting their highest levels since 2022? The refinancing surge of late 2024 marks a significant shift in the mortgage landscape, driven by falling interest rates and the Federal Reserve’s recent policy changes. Homeowners across the country are seizing opportunities to lower monthly payments, reduce loan terms, or tap into home equity for various financial needs. Keep reading to explore the factors driving this refinancing boom and how it’s affecting the mortgage market.

The Mortgage Refinancing Boom of 2024: Causes & Impact