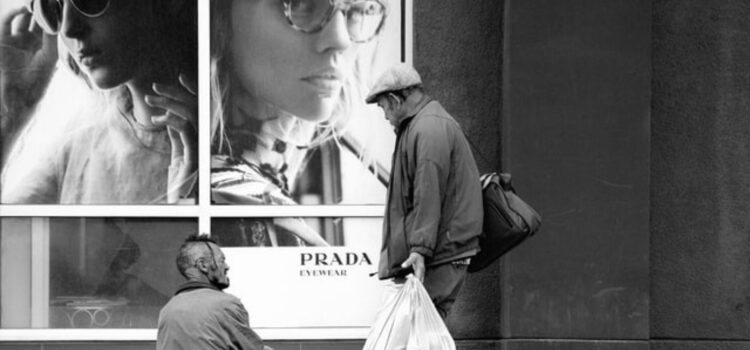

Are you tired of being a victim of your financial circumstances? Have you considered saving for your “F-You Money”? If your financial circumstances are still dictating your life, it’s time to start saving your “F-You Money.” The term “F-You Money” comes from James Clavell’s 1981 novel Noble House. Later, financial blogger J. L. Collins used the concept in his book The Simple Path to Wealth where he outlines a simple prescription that helped him and his family retire early and live off their investments. Here is why you should start saving for your F-You Money, and the sooner you do

“F-You Money”: The Key to Financial Security