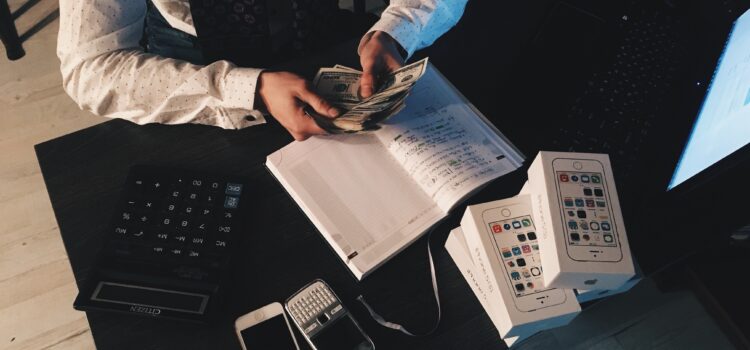

Why is it important to have a financial safety net? How many months’ worth of living expenses should your safety net cover? No matter how much money you earn, it’s important to have a financial safety net—a savings account with money you can use for emergencies—to prepare for worst-case scenarios. To start building your safety net, figure out how much you need to save to cover your living expenses so that you can decide how much money to set aside each month. In this article, we’ll explore how to automate contributions toward your safety net to ensure that you’re prepared

How and Why to Build a Financial Safety Net