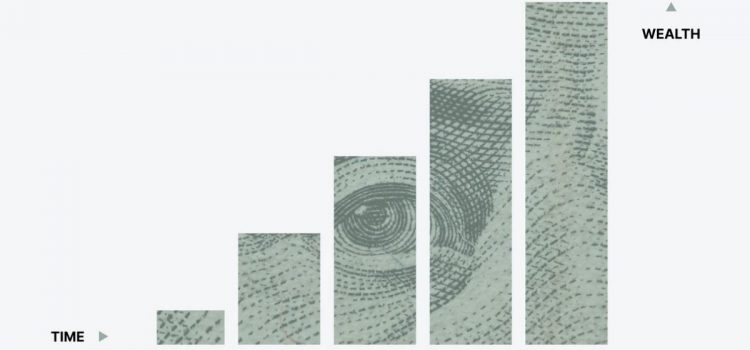

Do you have a plan to pay for your child’s education? What option is best? Paying for your child’s education likely will require advance planning and many years of investment. In The Wealthy Barber, David Chilton recommends having a mutual fund for this purpose. He discusses the advantages and the timing for when to redeem the funds. Read more for advice on how to save money for college.

How to Save Money for College: Mutual Funds & More