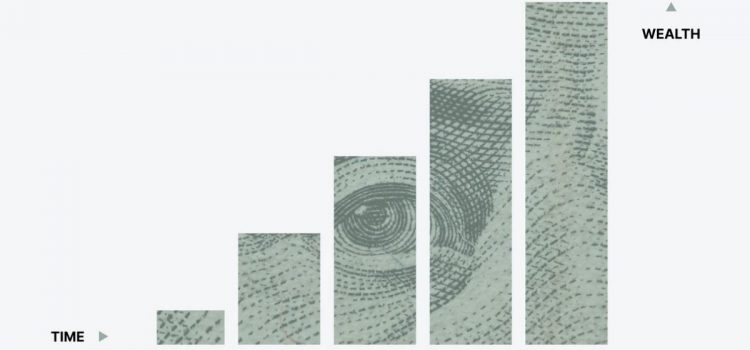

What’s the difference between an index vs. mutual fund? How do index funds and mutual funds make money for investors? Traditional index funds own shares of an entire market (e.g. the S&P 500) and aim to generate market-average returns. In contrast, mutual funds own shares of companies selected by their analysts and aim to generate profits by beating the market returns by buying and selling stocks at opportune moments. Keep reading to learn how index funds differ from actively managed mutual funds.

Index vs. Mutual Funds: What’s the Difference?