This is a free excerpt from one of Shortform’s Articles. We give you all the important information you need to know about current events and more.

Don't miss out on the whole story. Sign up for a free trial here .

What purpose does the debt ceiling serve? What are its pros and cons? Is abolishing the debt ceiling feasible?

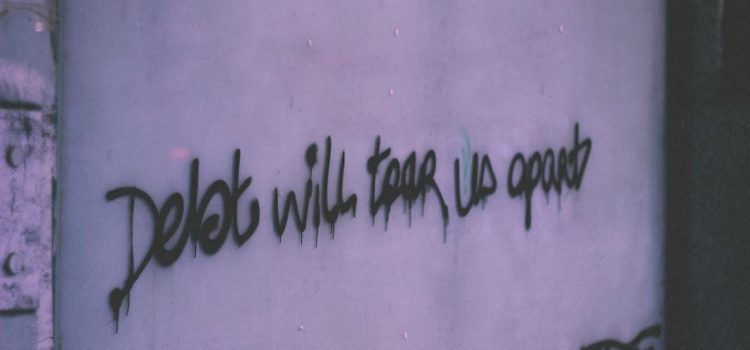

Many Americans agree that Congress’s increasingly chaotic debt ceiling negotiations have become a distracting and dangerous spectacle. But to date, calls to abolish the ceiling have fizzled.

We’ll examine why the US has a debt ceiling and what it would mean to abolish it.

Debt Ceiling Origins and Purpose

Should the US abolish the debt ceiling? Let’s take a look at the history of the debt ceiling and the pros and cons of abolishing it.

Congress implemented the debt ceiling in 1917 during World War I to simplify and streamline the debt issuance process and increase borrowing flexibility. Doing so enabled the Treasury to issue bonds up to a predetermined dollar amount so it didn’t have to seek Congress’s approval each time it needed money. This made it easier to finance war mobilization efforts.

But as the US engaged in more wars in the decades that followed, the US accumulated more debt. The debt ceiling today is more than $31 trillion.

When the country hits its debt limit it runs out of cash, can’t pay its obligations, and must wait for Congress to raise or suspend the ceiling. But an increasingly divided Congress has turned the once simple process into a game of brinksmanship and increased the country’s risk of defaulting.

Default Consequences

Analysts say the country will experience severe economic consequences if the US defaults on its debt, including:

- Ratings agencies will downgrade the country’s credit.

- The government won’t be able to pay military families or seniors receiving Social Security.

- Financial markets will tank.

- Businesses and average Americans won’t be able to borrow money.

- The country will enter a recession.

Americans will lose jobs and face higher mortgage, car loan, and credit card payments.

Debt Ceiling Pros

Historically, the debt ceiling was seen as a useful tool to keep the country’s finances in check and improve the government’s efficiency in funding federal operations and programs. More recently, Republicans and conservative economists have argued that in these politically divided times, the debt ceiling is:

- A necessary instrument to force critical conversations about US spending and ensure lawmakers’ accountability. The debt ceiling creates a hard deadline that requires legislators to discuss and decide upon how to deal with the country’s fiscal problems.

- The only mechanism to limit federal spending.

Debt Ceiling Cons

The debt ceiling has well-known flaws, including that it:

- Can be easily lifted—which can fuel fiscal irresponsibility.

- Lowers the nation’s credit rating and raises its debt.

- May not be constitutionality sound.

More recently, Democrats and centrist economists have argued that in today’s politically divided climate, the debt ceiling:

- Serves no purpose except as a political football. Legislators are increasingly using the debt ceiling as a tool for political leverage and a weapon.

- Increases the risk of default. Americans are so accustomed to Congress’s debt limit bickering and 11th-hour deals that they now expect a deal will always come through at the last minute.

- Has failed to limit the deficit. The debt ceiling has been raised many times, calling into question its usefulness in ensuring fiscal responsibility.

- Is an obstacle to appropriate, necessary conversations about budgetary spending. Increasingly, the US’s long-term economic challenges are being addressed in rushed, closed-door, debt-limit deals. They should instead be carefully deliberated in transparent Congressional committee processes.

Looking Ahead

Although many agree that legislators’ increasingly toxic debt ceiling negotiations put the US at risk, efforts to abolish it appear unlikely to succeed. House and Senate bills to eliminate it have failed to gain traction, and legal experts broadly agree that challenges to its constitutionality using the 14th Amendment will fail.

Thus, chances seem better than not that Americans will watch a rerun of this year’s tortured debt ceiling negotiations the next time around, in January 2025.

Want to fast-track your learning? With Shortform, you’ll gain insights you won't find anywhere else .

Here's what you’ll get when you sign up for Shortform :

- Complicated ideas explained in simple and concise ways

- Smart analysis that connects what you’re reading to other key concepts

- Writing with zero fluff because we know how important your time is