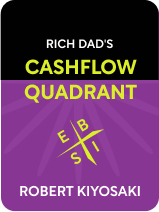

This article is an excerpt from the Shortform book guide to "Rich Dad's Cashflow Quadrant" by Robert T. Kiyosaki. Shortform has the world's best summaries and analyses of books you should be reading.

Like this article? Sign up for a free trial here .

What is the book Rich Dad’s Cashflow Quadrant about? What is the secret to wealth, according to its author Robert Kiyosaki?

Rich Dad’s Cashflow Quadrant is the sequel to Robert Kiyosaki’s international bestseller, Rich Dad, Poor Dad. The central principles in Rich Dad’s Cashflow Quadrant and Rich Dad, Poor Dad are the same: The best way to achieve wealth is to eschew security and to work hard at a “good job” in favor of cultivating boldness and developing assets that will generate passive income.

Below is a brief overview of Robert Kiyosaki’s book Rich Dad’s Cashflow Quadrant.

Rich Dad’s Cashflow Quadrant: Guide to Financial Freedom

Kiyosaki uses the concept of four “cashflow quadrants” to emphasize that it’s not what you do that makes the difference between achieving financial freedom and being stuck in a cycle of job dependency, but what kind of income you earn.

The Rich Dad books have appealed to millions. Many readers credit them with waking them up to the concept of passive income. The books also have their fair share of critics. By Kiyosaki’s own admission, the books are less a step-by-step guide to achieving wealth than a readable, engaging rundown of the core concepts and values about money Kiyosaki says you need to rethink. The downside to that, and perhaps the most common critique of the Rich Dad series, is that the books can lack convincing supporting evidence.

To Become Wealthy, Develop Assets

Most people believe that the key to wealth is getting a “good,” high-paying job. But according to Kiyosaki, the type of income you generate is more important than the type of work you do. He divides income into four categories, which he calls “cashflow quadrants”:

- Employees (E)

- The self-employed and small business owners (S)

- Big business owners (B)

- Investors (I)

According to Kiyosaki, the first two income categories, employees (E) and the self-employed and small business owners (S), are usually dead-ends on the road to wealth. The other two categories, big business owners (B) and investors (I), are the most conducive to accumulating wealth because those are the categories in which you can develop passive income in the form of assets. In his book Rich Dad’s Cashflow Quadrant, Robert Kiyosaki explains how to move from the E and S categories to the B and I categories, or at least add I income to existing E or S income.

The 4 Cashflow Quadrants

Kiyosaki’s “cashflow quadrants” represent four ways of generating income. The way you generate income defines your category, not what you do to earn it. You can, and in many cases should, generate income in multiple categories.

The E and S Categories: The Traditional Path

Traditional wisdom tells us to go to college to get a stable “good job” that will pay enough for a comfortable life and provide retirement benefits. That job is usually in the Employee (E) or Self-employed (S) category.

In the E category, employees generate income by agreeing to do work in exchange for a salary. They have a boss and a paycheck. Kiyosaki says employees choose the E category because they value security and certainty. Traditional thinking says E category jobs are stable because they offer steady income and a clear job description. But there are downsides—Kiyosaki says the biggest disadvantage of an E category job is lack of control over your own work.

(Shortform note: While Kiyosaki is quick to point out the downsides of being an employee, many people seek out E category jobs because they enjoy work they can only do in the E category. Professors, researchers, chefs, and teachers, for example, all make a salary and often attract people interested in the particular kind of work offered in the E category.)

In the S category, small business owners and the self employed are their business. They are their own boss, and they can also be the boss of other people, but without their labor, expertise, and management, their businesses can’t run. Their income is the profit from their business. Kiyosaki says people choose the S category because they value security and excellence in their work. According to Kiyosaki, people in the S category see it as the most stable way to generate income because they have the most control. The biggest disadvantage to trying to make a living in the S category is that most small businesses fail.

(Shortform note: Kiyosaki doesn’t mention that one of the biggest dangers of self-employment or owning a small business is not being able to fully plan for the amount of money you’ll make within a given period. E category workers are subject to job insecurity, like a round of layoffs because of trouble at the company or an economic downturn, but an S category worker’s job is also inherently at least a little insecure because they are not in a long-term contract with an employer.)

Kiyosaki notes that in the E and S categories, the harder you work, the more you have to work. As you work hard and become more successful in the E and S categories, you gain responsibility, which translates to more work. Even though your pay may jump, you’ll have less time to enjoy yourself spending it.

While these categories offered security in the 20th century, Kiyosaki argues that changes in the economy mean that they’re anything but secure in the 21st century. Kiyosaki lists five reasons the E and S category job trajectory no longer provides the “good jobs” of the past and is instead now a trap for job dependency.

Reason #1: College Doesn’t Guarantee a Good Job or Wealth

While higher education is still usually necessary, the skills we learn in college aren’t the skills that will lead us to wealth. Financial security and/or freedom is now detached from a job and attached to knowing the skills to succeed in business and investing, which we don’t usually learn in our undergraduate education, unless we study business.

(Shortform note: Due in part to the trend known as “degree inflation” where college degrees are required for jobs that don’t actually demand them, a college education may be more necessary than ever for getting a job. At the same time, 57% of Americans say a college degree doesn’t provide its money’s worth. Between 1989, four years before Rich Dad’s Cashflow Quadrant was published, and 2016, the cost of college (adjusted for inflation) nearly doubled.)

Reason #2: There Aren’t Enough Good Jobs

Kiyosaki identifies downsizing as one reason there are fewer “good jobs.” Because of cheap labor overseas, a trend toward consolidation in business, and automation, employers are cutting jobs and cutting pay.

(Shortform note: Experts also recognize the rise of the gig economy, labor laws that favor employers over employees, and income inequality as reasons there are fewer good jobs to go around.)

Reason #3: Your Job Won’t Provide a Secure Retirement

One of the biggest advantages to an E category job is a pension. From the 20th to the 21st century, however, the norm has shifted from a defined benefit system to a defined contribution system. In the defined benefit system, you were guaranteed a pension, which meant income for life after you stopped working. In the defined contribution system, you only get what you and your employer contribute during your working years. Consequently, you’re at risk of running out of income during your retirement. Since you aren’t guaranteed income for life, your pension is susceptible to market forces. In a crash, you could sustain significant losses.

(Shortform note: Until the 1980s, defined benefit pension plans were common, and originally, defined contribution plans were meant to exist alongside defined-benefit plans. Now, just 17% of private-sector workers have pension plans available to them. Companies prefer defined contribution systems because they’re cheaper and easier to manage.)

Reason #4: Debt and Taxes Will Bleed You Dry

The traditional path from higher education to a good job to a secure retirement doesn’t account for what Kiyosaki says your two biggest expenses will be in the E and S categories: debt and taxes.

- The more debt you take on, the more beholden you are to your job, because you need that income to pay back your debt each month. And unfortunately, according to Kiyosaki, the expectations of a good life on the traditional path increase our debt.

(Shortform note: Student loan and credit card debt are two major categories Kiyosaki covers. Average student loan debt in the U.S. is almost $40,000. The average American owes slightly over $8,000 in credit card debt.)

- When your pay jumps, so does your tax bracket, and there are fewer tax benefits in the E and S categories, and far more in the B and I categories.

(Shortform note: While the rich do use everyman investment tools like Roth IRAs, they also have access to stock deals and assets that are inaccessible to most.)

Reason #5: Inflation Will Dilute Your Savings

Kiyosaki is adamant that parking your money is one of the worst things you can do with it. He says when you save money, you’re really just letting it lose value due to inflation.

(Shortform note: In I Will Teach You To Be Rich, personal finance author Ramit Sethi agrees with Kiyosaki that saving your money means you’ll lose some to inflation. However, Sethi does not have the same doomsday outlook about the impact of inflation on the economy as a whole as Kiyosaki has. Like most economists, Sethi sees some inflation as a part of a healthy economy.)

The B and I Categories: The Way to Wealth

Kiyosaki says that while lower-, middle-, and even upper-middle-class parents teach their kids the out-of-date financial path we just outlined, rich parents teach their kids the income generation strategy of the Business owner (B) and Investor (I) categories.

While in the E and S categories you generate income in exchange for the work you do, in the B and I categories income comes primarily from assets you own. According to Kiyosaki, this is the surer path to financial freedom.

People in the B category control not only a business, but a business system. If they leave, the work still gets done. People in the B category own their business and generate income by its profit, though they no longer do the day-to-day labor of making it function. A B’s income is the profit from their business, and their business is considered an asset. B’s need to be skilled in delegation and leadership, as well as have a high degree of financial literacy.

In the I category, investors commit money (called capital) to something and expect to make a profit. Beyond the initial investment, they don’t have to work day to day like those in the other categories do. Instead, their livelihood comes in the form of assets that generate passive income. Examples of passive income include dividends from stocks, interest on bonds, and rental income. I’s need to be comfortable with risk, since managing risk is the foundation of investing.

Kiyosaki says the best path to wealth is to make a significant amount of money in the B category and then use that capital as an investor in the I category. The kind of wealth that provides financial freedom is almost always generated in the I category, where it compounds without your labor.

(Shortform note: You only need to generate B category-level capital in order to invest if you’re aiming to be a capitalist. While Kiyosaki devotes a lot of space to advocating readers set their sight on that kind of wealth, you don’t need to own a B-category business to invest at a smaller scale, even if you’re aiming to “cross over” to living on passive income. The central function of investing remains the same whether you’re a high-flying B or a worker in the E or S categories investing for retirement.)

The reason B and I income is a much surer bet for generating wealth than E and S income is, as we previewed, the fact that assets are the way to compound your money without your labor. The income you generate from assets is called passive income. While in the E and S categories, your income minus your expenses and liabilities equals the money you have to live on, in the B and I categories, your income equals passive income from your ever-compounding assets minus your expenses and liabilities.

Success in the B and I categories requires understanding a different kind of logic and adopting a different value system than the logic and value system of the E and S categories. In the B and I categories, you:

- Make yourself, not other people, rich. If you are not the person most upstream from your labor, someone else is profiting off you.

- Profit from other people’s money and labor. By owning a system that runs on labor that’s not your own, or by investing with other people’s or a bank’s money, you can eventually gain income that you don’t have to work for every day.

- Know that society rewards wealth. Beyond the fact that a bigger investment can yield bigger returns, society rewards wealth in the form of tax advantages.

Success in the B and I Cashflow Quadrants

Kiyosaki argues that succeeding in the B and I categories is as much a matter of skill in business and investing as it is about cultivating the mental fortitude to stick with a long-term and challenging task: generating wealth.

Key to Success #1: Be Financially Literate

According to Kiyosaki, there are two groups of people: people who understand how money flows and grows, and people who don’t. Those who don’t usually remain solely in E and S categories, without assets or the possibility of growing their income into wealth and destined to make money for other people.

On the other hand, people who are fluent in money know that the best way to wealth is to be in the B and I categories, and they end up making money for themselves. An understanding of money, finance, business and investing is crucial in generating wealth, whether you’re looking to work in business and investing full time, or supplement your E and S income with passive income from investing.

(Shortform note: It’s harder, and more important, to be financially literate today than it was in the past. Financialization of the U.S. economy has meant saving, investment, and retirement options are now more complicated than they’ve ever been. Between 1950 and 2019, the financial sector’s share of the U.S. GDP rose from about 3% to over 20%.)

- Be an active learner. Because we don’t receive an adequate financial education from our parents, from secondary schools, or in college, you’ll need to be purposeful about developing your financial education. Learn by doing, consider furthering your formal education, and commit yourself to independent research.

(Shortform note: When Kiyosaki wrote Rich Dad’s Cashflow Quadrant, the internet was nowhere near as ubiquitous as it is now. Email newsletters can be a great way to learn about investing or a particular industry, or develop your financial knowledge in general. They can also help you cut through the seemingly endless advice on the internet.)

Become a Big Business Owner

Kiyosaki offers five strategies for breaking into the B category, all of which are also ways to increase your financial knowledge:

Strategy #1: Find a mentor in the kind of business you want to enter.

A mentor will help you sift through the noise and will teach you what’s really important, and they can also be a sounding board and a guide as you learn by doing. Be sure your mentor is successful in the field you want to enter, not a professional advisor you’re paying.

(Shortform note: Research shows that having a mentor makes you better at your work, happier doing your work, and more likely to move up in your career. Three-quarters of people say having a mentor would help them, but more than half of people don’t have one.)

Strategy #2: Work for a company in the field you want to own a business in for 10-15 years.

After that amount of time, Kiyosaki says you’ll understand all the elements of that kind of business system and be ready to strike out on your own.

(Shortform note: The company you work for today could be your competition in the future. Even if your employer won’t be a primary competitor, you can learn a lot from studying competitors that sell to a slightly different audience, or that offer a different but related product.)

Strategy #3: Buy a franchise.

In the above two strategies, you’re learning to build a business system. When you own a franchise, the system already exists. Your job is to make sure the people who work for you are running the system as best as possible.

(Shortform note: Watch out for hidden costs, misleading success statistics, and noncompete clauses when shopping for a franchise.)

Strategy #4: Become a network marketer.

Network marketing is another way to join a pre-existing business system. You also don’t need nearly as much start-up capital or business acumen as you do when you buy a franchise, and the organization you work with can offer you valuable business education.

(Shortform note: Some network marketing schemes are scams and can be classified as pyramid schemes. Single-tier systems are safer than multi-tier systems, where top-tier salespeople make money off lower-tier salespeople and which can be pyramid schemes.)

Become an Investor

Kiyosaki offers three steps to begin generating passive income through asset ownership:

1. Get out of debt. You need capital to invest, and it’s hard to have enough to spare when you’re in significant debt.

(Shortform note: Kiyosaki differentiates between good debt and bad debt; sometimes going into debt is a necessary part of investing.)

2. Decide what kind of investor you want to be. Kiyosaki emphasizes how important it is to know how you’re going to use the I category to achieve wealth. You can use a financial advisor or learn to invest yourself as a serious side practice to generate retirement or supplemental income, or you can dedicate yourself to investing as a full-time job to “crossover” into financial freedom, where you live off your investment income.

3. Get started by investing in the stock market and in real estate. Call stockbrokers and ask for their guidance, then open a small trading account. In real estate, buy, sell, and manage your own properties. No matter what you decide to invest in, learning and research are key to mitigating the risk that comes with investing.

(Shortform note: Kiyosaki is shorter on specifics for investing than Sethi. Sethi recommends starting with stock market investing, beginning with mutual and index funds, or, if you’re willing to sacrifice some profit for ease, investing in target-date funds.)

Key to Success #2: Become Mentally Prepared to Succeed

In both the B and I categories, you need to develop mental and emotional fortitude. Both starting out in the B and I categories, and especially transitioning from the E and S categories to the B and I categories, are long, tough challenges.

- Get over your fear of money. Kiyosaki says fear of money—fear that you don’t understand it, fear that you won’t have enough, fear of taking financial risks or a thousand other worries related to money—makes sense. But before you can make any change to your financial situation, Kiyosaki emphasizes that you need to have a healthy relationship with money.

(Shortform note: In Your Money or Your Life, Vicki Robin agrees that a core part of financial freedom is freedom from fear and worry about money. She argues that by consciously connecting money to your values, purpose, and dreams, you can diffuse some of your financial anxiety.)

- Get started ASAP. Undertaking a goal as big as succeeding as the owner of a large business or learning to invest can be paralyzing. Take baby steps because they’re much easier to start, and build your wealth as you build your skills.

(Shortform note: Kiyosaki emphasizes that the journey to financial security and freedom is a marathon, not a sprint. James Clear’s concept of “atomic habits” from his book of the same name is useful for breaking down a big undertaking into smaller parts. Atomic habits are small adjustments that are easier to start and will eventually compound into changed behavior.)

- Believe in yourself and have determination. Set yourself up for success by expecting to be successful in the long run. Your ability to succeed depends on your ability to respond to challenges without being knocked off your path; grittiness is essential.

(Shortform note: In her book Grit, Angela Duckworth argues that between two people with equal ability, the grittier person will achieve more success, and that grit is a skill that can be honed with practice.)

———End of Preview———

Like what you just read? Read the rest of the world's best book summary and analysis of Robert T. Kiyosaki's "Rich Dad's Cashflow Quadrant" at Shortform .

Here's what you'll find in our full Rich Dad's Cashflow Quadrant summary :

- Why the traditional path of college to career doesn't work

- Which types of income will lead you to financial freedom

- An in-depth look at Robert Kiyosaki's four cashflow quadrants