This article is an excerpt from the Shortform book guide to "The Intelligent Investor" by Benjamin Graham. Shortform has the world's best summaries and analyses of books you should be reading.

Like this article? Sign up for a free trial here .

What is Ben Graham’s The Intelligent Investor about? What advice does Graham give about investing, and why is his advice so effective?

Ben Graham was a successful investor in the earlier part of the twentieth century. Ben Graham’s The Intelligent Investor has been reprinted many times and is often referenced as a fantastic guide for investing by major figures, including Warren Buffett.

Read more about Ben Graham, The Intelligent Investor, and the best investment advice.

Ben Graham: The Intelligent Investor

Investing well over the long term does not require incredible intelligence or deep insight. Instead, it requires two things:

- A rational framework for making decisions

- Preventing your emotions, and other people’s emotions, from overriding your framework

With these two elements, and without extensive trading experience, you can do better than more financially-educated people who lack patience, discipline, and emotional control.

Investing successfully in stocks requires keeping a few key principles in mind:

- A stock is not just a mere object you trade. It is a piece of ownership in a business. Therefore, the stock has a fundamental value that is often not the share price. Understand the business, and you understand the fundamental value.

- Pay attention to the price at which you buy stock. The more you pay for a stock, the lower your return will be. Buying stock carelessly, with the expectation that you can buy anytime at any price and still profit, is a mistake. As Graham says, “buy your stocks like you buy your groceries, not like you buy your perfume.”

- The market has constant mood swings. At times, it is over-optimistic, which makes stocks too expensive. At other times, it is pessimistic, which makes stocks cheap. The key is to buy from pessimists and sell to optimists.

- Keep a “margin of safety”—don’t get carried away and overpay for a stock, or a downturn can cause irrevocable losses.

Warren Buffet read this book when he was 19 years old, and he still calls this “by far the best book about investing ever written. Here is a brief intro to Ben Graham and The Intelligent Investor.

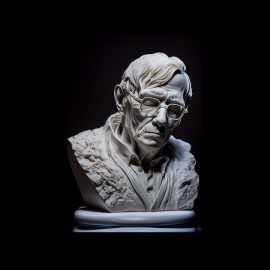

Brief Biography of Benjamin Graham

Graham was born in 1894 and lived his childhood in New York. His father died when he was 9, the family business failed, and the family became poor. Her mother traded stocks on margin and became bankrupt in the stock market panic of 1907. This incident deeply influenced Graham’s thinking on the importance of not suffering grave losses in investing.

Graham attended Columbia for college and entered Wall Street. Here he obsessed over analyzing stocks and companies in minute detail. He eventually founded his investment firm, the Graham-Newman Partnership, where he employed a young Warren Buffett. Over 20 years, his firm returned 14.7% annually (after fees), compared to 12.2% for the stock market.

In 1956, Graham Graham retired and closed his partnership and continued teaching and writing, sharing his principles of value investing worldwide. He died in 1976, a few years after his last revision of this book.

Graham led the movement of “value investing” and deeply influenced some of the world’s most successful investors, most notably Warren Buffett and Charlie Munger of Berkshire Hathaway.

Topics in Ben Graham’s The Intelligent Investor

Investing well over the long term does not require incredible intelligence or deep insight. Ben Graham says in The Intelligent Investor that it requires two things:

- A rational framework for making decisions

- Preventing your emotions, and other people’s emotions, from overriding your framework

With these two elements, and without extensive trading experience, you can do better than more financially-educated people who lack patience, discipline, and emotional control.

Investing successfully in stocks requires keeping a few key principles in mind:

- A stock is not just a mere object you trade. It is a piece of ownership in a business. Therefore, the stock has a fundamental value that is often not the share price. Understand the business, and you understand the fundamental value.

- Pay attention to the price at which you buy stock. The more you pay for a stock, the lower your return will be. Buying stock carelessly, with the expectation that you can buy anytime at any price and still profit, is a mistake. As Graham says, “buy your stocks like you buy your groceries, not like you buy your perfume.”

- The market has constant mood swings. At times, it is over-optimistic, which makes stocks too expensive. At other times, it is pessimistic, which makes stocks cheap. The key is to buy from pessimists and sell to optimists.

- Keep a “margin of safety”—don’t get carried away and overpay for a stock, or a downturn can cause irrevocable losses.

This book covers two major types of intelligent investors—defensive investors and aggressive investors—and advises how each should invest. It also covers general investment principles and market behavior, popularizing Graham’s famous concepts of Mr. Market and Margin of Safety.

Defensive vs. Aggressive Investors

Another idea in Ben Graham’s The Intelligent Investor is to outline the types of investors. Having distinguished investors from speculators, Graham defines two different types of intelligent investors: defensive investors and aggressive (or enterprising) investors.

Defensive investors want to avoid spending too much time on investing. They like simplicity and don’t love thinking about investments or money. Their goal is to perform on average, in line with the market, and to avoid serious mistakes.

Aggressive investors are willing to devote serious time and energy to research stocks and select good ones. They enjoy thinking about money and see smart investing as a competitive game they want to win. Their goal is to achieve better returns than the passive investor (Graham says an extra 5% per year, before taxes, is necessary to justify all the effort.)

Both approaches can be intelligent and can perform well. The key is choosing the right type of investment for your temperament and goals, to stick with it over your entire investment timeline, and to keep your emotions well under control.

Market Fluctuations and Mr. Market

When asked to predict what the market would do, the financier J.P. Morgan said, “it will fluctuate.”

You can be sure that the market will fluctuate. In all likelihood, you will not be able to predict when and how the market fluctuates. You can, however, respond to fluctuations in two critical ways:

- Steel yourself mentally for the fluctuations. Prepare for the idea that your portfolio may decline by 30% from its high point, and don’t tie your emotions to these fluctuations.

- Watch patiently and prepare to spot opportunities when they do appear. When the market sours on a stock, it can be an overreaction and present a bargain buying opportunity.

———End of Preview———

Like what you just read? Read the rest of the world's best book summary and analysis of Benjamin Graham's "The Intelligent Investor" at Shortform .

Here's what you'll find in our full The Intelligent Investor summary :

- Key advice from what Warren Buffett considers the "best book about investing"

- The 2 major indicators you should use for evaluating stocks

- How you can use aggressive or defensive investing strategies