This article is an excerpt from the Shortform book guide to "Technological Revolutions and Financial Capital" by Carlota Perez. Shortform has the world's best summaries and analyses of books you should be reading.

Like this article? Sign up for a free trial here .

What is production capital and how does it fit into the phases of technological revolutions?

Production capital is the infrastructure that develops to make phase 3 of technological revolutions possible. This part of the industrial revolution comes about when businesses have synergy, and production is seen as a wealth-building effort.

Read more about production capital and phase 3 of technological revolutions.

Phase 3: Synergy

Using the infrastructure developed in Frenzy and the regulatory safeguards in Turning Point, the technological revolution diffuses across the whole economy. A “good feeling” sets in with increasing coherence. Business is satisfied about its positive social role. Technology, and even finance, is seen as a positive force, and can show that capital is a factor of production.

Financial Capital and Production Capital Recouple

Production capital is now recognized as the wealth-creating agent, with financial capital as the facilitator.

Production Capital

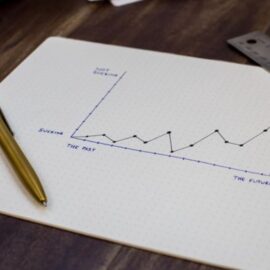

Is capital a factor of production? For entrepreneurs and people working in the new revolution, the path to success has been successfully signaled. People can join the bandwagon with lower risk. 1 → n growth occurs.

- Entrepreneurial activity moves “up the stack.” Where the excitement in Installation was in building infrastructure, much of excitement in Deployment is building the application layer on top of the infrastructure.

- For example, during the installation phase of the auto revolution, the action was in building cars. In the deployment phase, the action was in the highway system, suburbanization, retail, and other second-order effects.

The new firms from the installation period are now giants.

Financial Capital

Financial capital serves to facilitate production capital, less exuberant than in Frenzy but more stable and still profitable.

Financial capital creates instruments of credit that facilitate the new paradigm.

- The second revolution in the 1830s saw joint stock for large projects and growth of capital markets.

- The third revolution from 1870s onward saw limited liability and legislation for giant industrial corporations.

- The fourth revolution post-WW2 saw personal banking services and consumer credit for consumption of mass-produced home goods.

- The fifth revolution sees challenges in the paradigm of intangible information as capital goods, and of products with zero marginal cost. (Shortform examples: New instruments may include crowdfunding and cryptocurrency.)

Paper values and real values are more closely aligned, so growth and dividends are more real than in Frenzy.

Perez argues this may be the only period when aggregate statistics are reliable, since the economy is in relative harmony (and not with stark differentiation between old and new sectors, as in Irruption). See how this works with production capital and how capital is a factor of production.

The Paradigm Diffuses throughout Society

Feedback effects reinforce growth. The raw labor and supplies are readily available, distribution networks are in place, new products are intercompatible, social acceptance increases, cost of inputs and infrastructure is reduced – all driving a flywheel effect for diffusion.

- Without roads, gasoline stations, and mechanics, people can’t use automobiles. Yet with a critical mass, enough automobiles are needed to make running a station profitable, thus making it easier to own an automobile, thus allowing more gas stations to exist. A virtuous cycle thus occurs.

- Likewise, the decreasing cost of web servers in the 2000s prompted many more services to arise, thus enabling improvements in infrastructure (as in AWS) that further lowered cost.

Institutional enablers like regulation, specialized education, and financial innovations continue diffusion of the paradigm.

- For example, in the Age of the Automobile, the traffic code and consumer credit for buying automobiles further diffused the paradigm.

New means of expanding demand to successive layers of the population arise, involving the middle and working classes and enabling economies of scale.

- This includes making the products user friendly, and cost reduction of inputs and infrastructure.

Social Adaptation in Synergy

Culture adapts to the logic of the technologies. Consumers accept the progression of innovation as normal and contribute to production capital.

- In the Information Age, there was rapid progression from home PCs to laptops to mobile phones to apps.

- The paradigm has diffused and proven its power sufficiently to be installed in people’s minds as the new best practice.

- This social momentum eventually becomes its own inertial force, rejecting innovations that disrupt the prevailing paradigm. This is itself helpful by allowing the full spread of benefits of the revolution and preventing kneejerk change for novelty’s sake.

Accessory branches that help diffuse the paradigm also experience growth.

- For example, construction, transport, trade accompanying the particular nature of the revolution also thrive.

Employment rises steadily and (depending on the institutional framework) there can be a shared feeling of improving quality of life.

———End of Preview———

Like what you just read? Read the rest of the world's best book summary and analysis of Carlota Perez's "Technological Revolutions and Financial Capital" at Shortform .

Here's what you'll find in our full Technological Revolutions and Financial Capital summary :

- What happened during the 2000 tech bubble and the 2002 crash

- The 5 technological revolutions that reshaped society since 1771

- How you might be able to predict and prepare for the next technological revolution